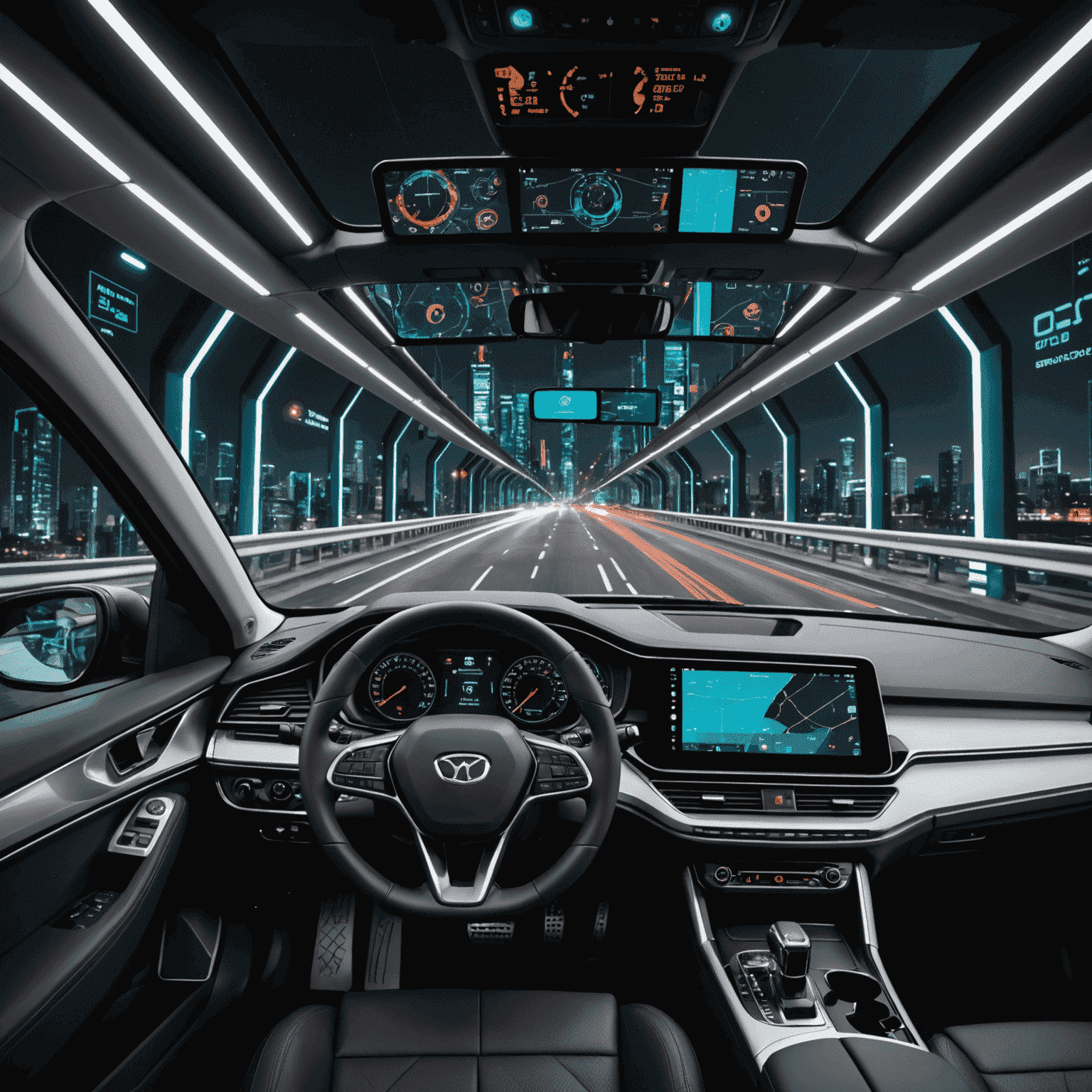

The Future of Auto Insurance: AI and Telematics Integration

The landscape of auto insurance is rapidly evolving, with artificial intelligence (AI) and telematics leading the charge towards a more personalized and data-driven approach. This integration is set to revolutionize how insurance companies assess risk, price policies, and interact with their customers.

The Rise of Telematics in Auto Insurance

Telematics devices, which collect and transmit data about a vehicle's usage and performance, have become increasingly sophisticated. These smart systems can now monitor:

- Driving behavior (speed, acceleration, braking patterns)

- Time and frequency of vehicle use

- Location and routes taken

- Vehicle diagnostics and maintenance needs

This wealth of data allows insurance companies to create highly accurate risk profiles for individual drivers, moving away from broad demographic-based pricing models.

AI-Powered Analysis: The Game Changer

The true power of telematics is unlocked when combined with AI algorithms. These intelligent systems can:

- Process vast amounts of data in real-time

- Identify patterns and trends in driving behavior

- Predict potential risks and accidents before they occur

- Offer personalized feedback and coaching to drivers

Predictive Modeling: Shaping Future Policies

AI-driven predictive modeling is set to transform how insurance policies are structured and priced. By analyzing historical data alongside real-time information, these models can:

- Accurately forecast claim likelihood for individual drivers

- Dynamically adjust premiums based on ongoing driving performance

- Identify and reward safe driving behaviors

- Proactively suggest risk mitigation strategies to policyholders

The Benefits for Consumers and Insurers

The integration of AI and telematics in auto insurance offers numerous advantages:

For Consumers:

- More accurate and fair pricing based on actual driving behavior

- Incentives for safe driving, potentially leading to lower premiums

- Personalized feedback to improve driving skills

- Faster claims processing and more transparent assessments

For Insurers:

- Enhanced risk assessment and pricing accuracy

- Reduced fraudulent claims through data verification

- Improved customer engagement and loyalty

- Potential for new product offerings and services

Challenges and Considerations

While the future of auto insurance looks promising with AI and telematics, there are important considerations:

- Data privacy and security concerns

- Regulatory compliance and ethical use of personal data

- Ensuring fairness and avoiding discrimination in AI algorithms

- Consumer education and acceptance of new technologies

Conclusion

The integration of AI and telematics in auto insurance represents a significant shift towards more intelligent monitoring systems. As these technologies continue to evolve, we can expect a future where auto insurance is not just a financial safety net, but an active partner in promoting safer roads and more responsible driving.

For consumers, particularly in Canada where Xavuraga has its office, this means a more personalized and potentially cost-effective approach to auto insurance. As these smart insurance solutions become more prevalent, drivers may find themselves with greater control over their premiums and a deeper understanding of their own driving habits.

The road ahead for auto insurance is clear: it's data-driven, intelligent, and tailored to individual needs. As we embrace this technological revolution, both insurers and policyholders stand to benefit from a safer, more efficient, and more equitable insurance landscape.